Port Coquitlam’s Award Winning And Trusted Mortgage Broker

Find the best mortgage rates quickly and simply

Get Pre-approved What Can I Afford?Rated 5 stars by our clients!

Milka Lukacevic

Email Now

milkamortgages@gmail.comAward Winning Port Coquitlam and BC Mortgage Broker

Mortgages and Financing Made Easy!

First Time Homebuyers, Renewals, Refinancing , Self-Employed solutions made easy with Expert Mortgage Solutions.

Our Lending Advantage!

Fast

lending approvals

Low Rates

great pricing and industry low fees

Trust

experience that counts

Peace of Mind

Rely on my experience

Building you a better Mortgage

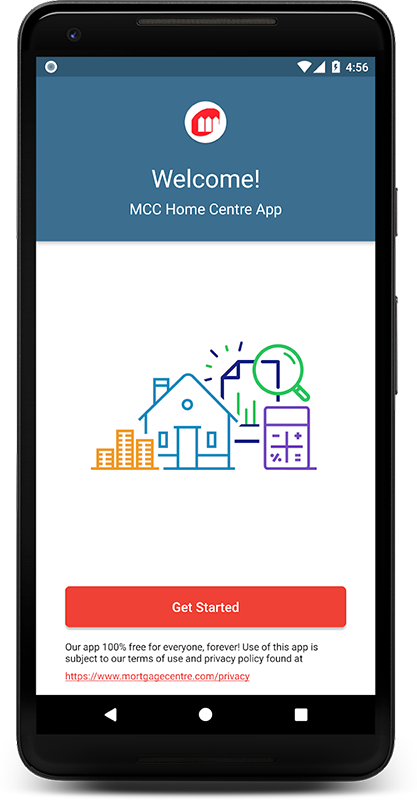

Download my Mortgage Planner App

My Mortgage Planner App gets you access to a wide variety of premium tools to help plan your mortgage.

What can you do with my app:

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Trending Industry Updates

as of March 9, 2026